Demystifying Stock Analysis: A Quick Guide for Investors

Stock analysis may sound like a daunting task, akin to navigating a complex maze. However, it’s more like studying a map before embarking on a journey – essential for making informed decisions in the world of investing. Let’s delve into this subject, breaking it down into simpler terms to empower beginners to approach stock analysis with confidence.

Understanding Stock Analysis

At its core, stock analysis involves evaluating various aspects of a stock, a particular sector, or the broader market. Analysts delve into financial statements, market trends, and economic indicators to gauge the potential performance of a stock in the future.

Fundamental Analysis: Unveiling the Company’s Core

Fundamental analysis is like peeling back the layers of an onion to reveal its core. Similarly, it involves scrutinizing a company’s financial records, economic reports, and overall market position. This analysis unveils the company’s financial health, growth prospects, and potential risks.

Technical Analysis: Deciphering Price Movements

On the other hand, technical analysis is like deciphering the language of the market. By studying past price data and chart patterns, analysts attempt to predict future price movements. It’s like reading the signs on the road to anticipate where the market might be heading.

Navigating the Limitations

While stock analysis can provide valuable insights, it’s crucial to acknowledge its limitations. Analysts often work with incomplete information, and predicting future events introduces a level of uncertainty. Moreover, biases like confirmation bias can cloud judgment, leading to misguided decisions.

Choosing Your Approach

There’s no one-size-fits-all approach to stock analysis. Depending on your objectives and available information, you might lean towards fundamental, technical, or quantitative analysis. The key is to use a combination of techniques to gain a holistic understanding of potential investments.

Navia’s Stock Analysis Features: A Closer Look

To discover how to use the stock analysis feature in Navia App watch the video below.

Navia’s stock analysis feature offers a comprehensive toolkit for investors:

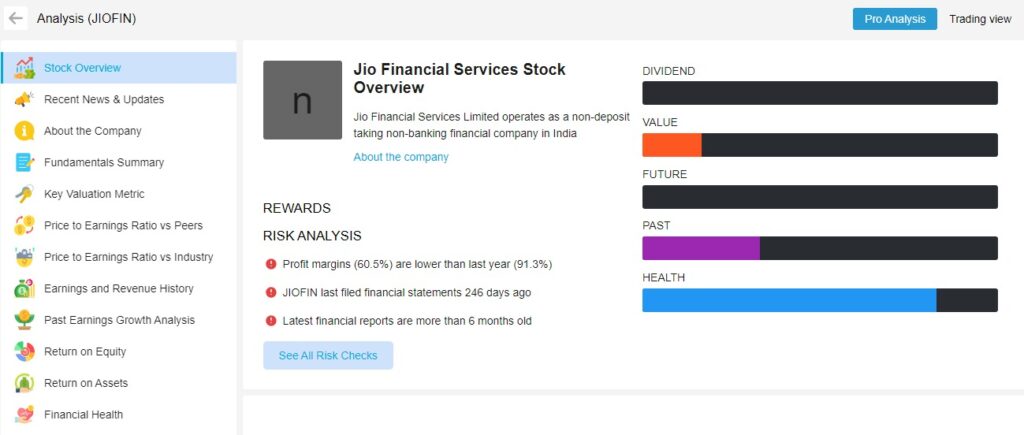

🔸 Risk Analysis:

Assess potential pitfalls that could affect the stock’s performance, enabling informed decision-making while managing risk exposure.

🔸 News & Updates:

Stay informed about recent developments to react promptly to changes that may impact the stock’s value.

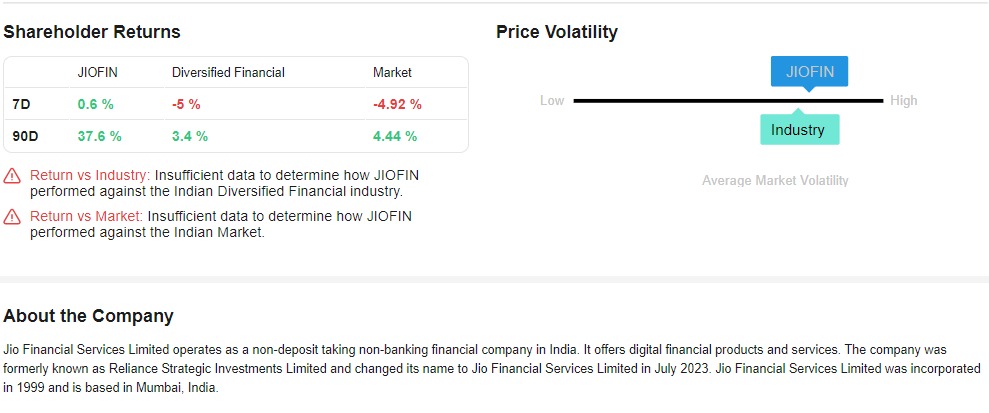

🔸 Shareholder Returns:

Analyze profitability and attractiveness as an investment, guiding decisions on financial gains.

🔸 About the Company:

Understand the company’s background for evaluating its long-term viability.

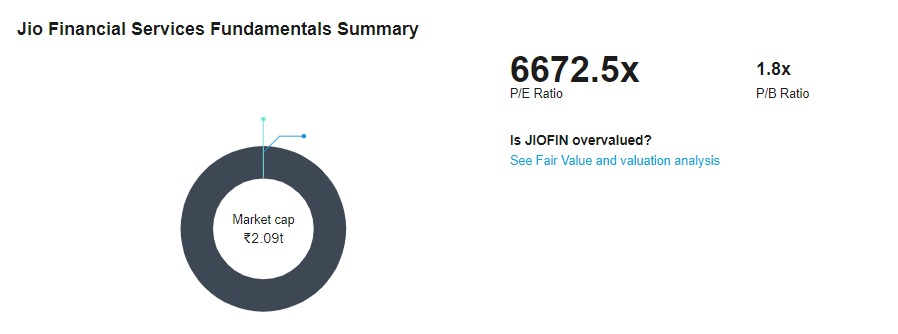

🔸 Financial Services Fundamentals Summary:

Examine financial metrics relative to industry peers for assessing competitive position and growth potential.

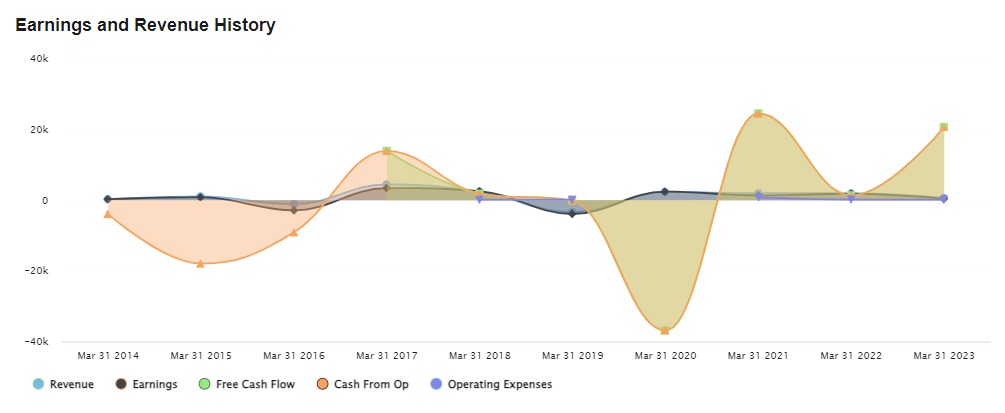

🔸 Earnings & Revenue:

Gauge profitability and revenue-generating capabilities for informed decisions about valuation and growth prospects.

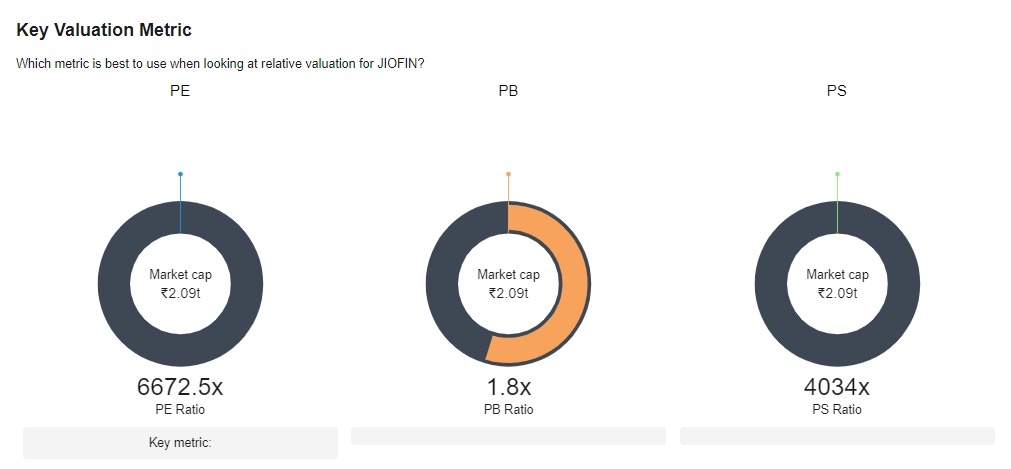

🔸 Key Valuation Metrics:

Evaluate attractiveness relative to earnings, sales, book value, and cash flow.

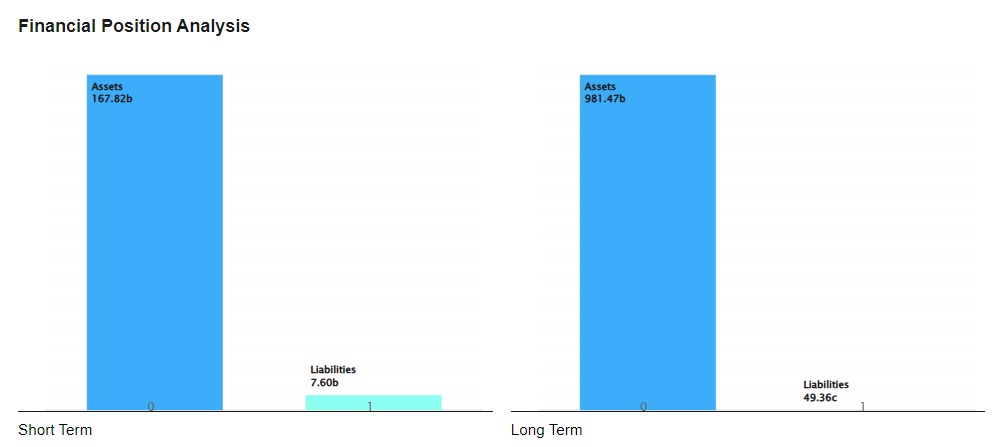

🔸 Financials:

Assess stability, liquidity, profitability, and cash flow.

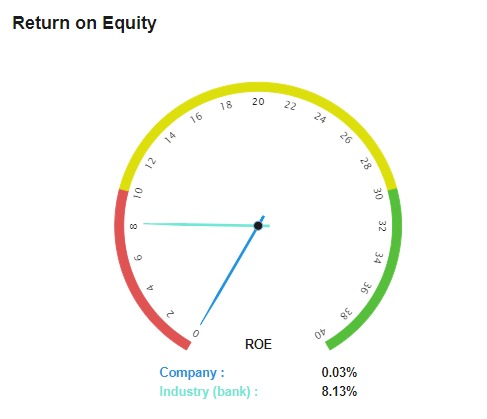

🔸 Returns Analysis:

Compare historical returns against benchmarks to evaluate past performance and potential for future returns.

Here’s an engaging video demonstrating how to utilize Navia’s stock analysis feature.

Diving into stock analysis can be intimidating, but understanding both fundamental and technical analysis equips investors with valuable tools for navigating the market confidently. Despite its limitations, tailored approaches combined with tools like Navia’s stock analysis feature offer a holistic perspective, acting as a compass for informed decision-making, risk management, and staying updated on market developments as investors embark on the adventure of investing.