How To Identify Good Stocks?

Investing in stocks can be a complex puzzle, especially for newcomers to the financial world. With numerous companies listed on the stock exchange, it’s natural to feel overwhelmed. However, with a systematic approach and some basic knowledge, identifying good stocks can become a manageable task. Let’s delve into the essential steps to help even non-finance individuals make informed investment decisions.

Understanding the Basics

Before we jump into identifying good stocks, let’s grasp some fundamental concepts:

🔹 Stock Market – The stock market is the marketplace where individuals and institutions trade shares of publicly listed companies. In India, prominent stock exchanges include the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

🔹 Stock – A stock represents ownership in a company. When you buy shares of a company’s stock, you become a shareholder and own a part of that company.

🔹 Investment Goals – Establishing your investment objectives is essential. Do you aim for long-term growth, consistent income from dividends, or a blend of both? Your goals will shape your approach to selecting stocks.

Identifying Good Stocks

Now, let’s delve into the key factors to consider when identifying promising stocks for investment.

1. Defining Investment Objectives:

Establishing investment goals is crucial, as they guide the selection process for stocks. Older investors prioritize capital preservation, while younger ones seek growth. Those desiring regular income prefer high dividend yields, while growth-oriented investors favor innovative companies. Investors focused on preserving capital opt for established businesses with steady profits.

2. Evaluating Competitive Advantage:

Assessing a company’s sustainable competitive advantage, often termed as a moat, is essential for long-term success. Factors like scale, brand recognition, switching costs, network effects, and intellectual property contribute to a strong moat. Examining the durability of this advantage ensures sustained success and benefits for investors.

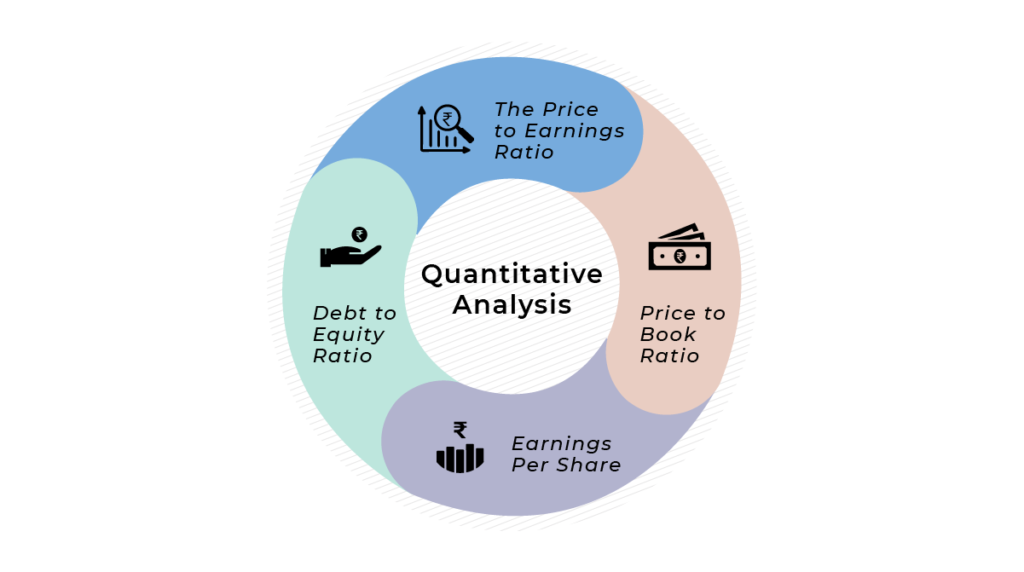

3. Conducting Quantitative Analysis:

Quantitative analysis involves scrutinizing a company’s financial data to determine its intrinsic value. Key financial statements such as the balance sheet, income statement, and cash flow statement offer insights into financial health. Metrics like price-to-earnings ratio (P/E), price-to-book ratio (P/B), earnings per share (EPS), debt-to-equity ratio, and current ratio aid in assessing performance and valuation.

🔶 The Price to Earnings Ratio (P/E ) – compares a company’s stock price to its earnings per share (EPS). A high P/E compared to the industry average suggests potential overvaluation. It’s important to consider factors like growth prospects and market sentiment when interpreting P/E ratios.

🔶 Price to Book Ratio (P/B)- compares a company’s market value to its book value per share. Significant deviations from the industry average may indicate undervaluation or overvaluation. Assessing specific circumstances, such as growth potential and asset quality, is crucial in interpreting P/B ratios.

🔶 Earnings Per Share (EPS)- measures a company’s profitability by dividing its net income by outstanding shares. Steady EPS growth over five years indicates consistent profit generation. This reflects effective cost management and revenue growth, potentially benefiting shareholders.

🔶 Debt to Equity Ratio- shows how much debt a company has compared to the ownership stake held by shareholders. Varying industry norms exist for acceptable debt levels. High debt can increase financial risk, especially during economic challenges. Comparing with industry peers helps assess a company’s leverage and financial stability.

4. Performing Qualitative Analysis:

Qualitative analysis delves beyond numerical data to focus on intangible factors contributing to a company’s excellence. Factors like brand recognition, consumer trust, innovation, and uniqueness are pivotal in attracting investors. Strong brand equity, exemplified by companies like Apple, fosters consumer loyalty and adoption of products.

5. Meeting Fundamental Criteria:

Before investing, stocks must meet fundamental criteria. Assessing metrics such as P/E ratio, P/B ratio, EPS growth, debt-to-equity ratio, and current ratio provides insights into financial and fundamental performance. Thorough research supported by multiple metrics enhances decision-making.

6. Evaluating Managerial Efficiency:

Understanding a company’s management and its efficiency is vital for informed investing. Monitoring management tenure, shareholder patterns, and participation in meetings like quarterly reviews and annual general meetings offer valuable insights into stability and growth prospects.

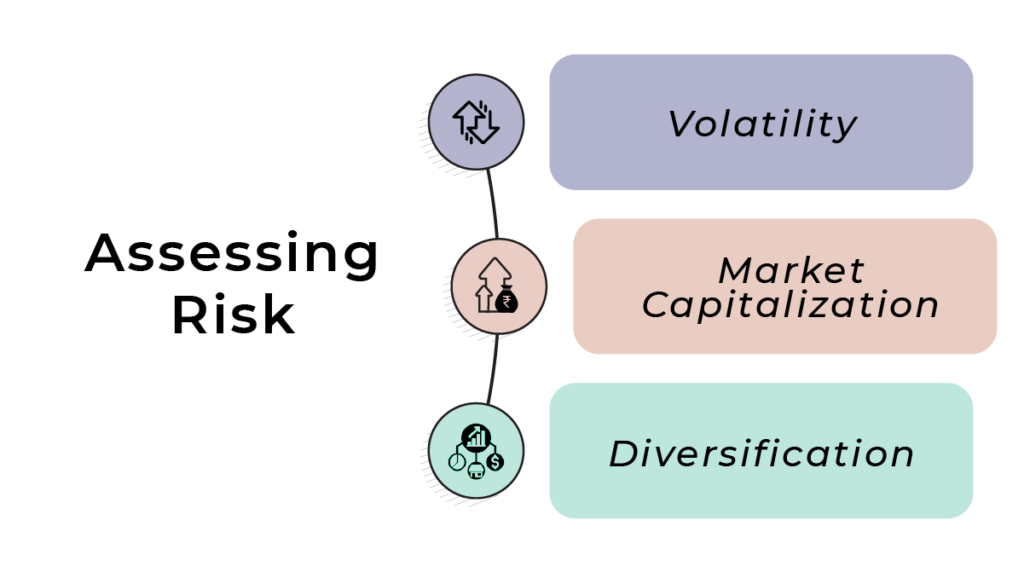

7. Assessing Risk:

Considering various factors contributing to risk is crucial when evaluating potential investments. Understanding and evaluating elements such as volatility, market capitalization, and diversification align investment decisions with risk tolerance and financial objectives.

🔹 Volatility: Assessing the volatility of a stock is important; while high volatility may present profit opportunities, it also entails higher risk. Understanding one’s risk tolerance and comfort with potential price fluctuations is essential for decision-making.

🔹 Market Capitalization: Market capitalization reflects a company’s total value and provides insights into its stability and resilience. Larger, established companies generally exhibit lower volatility compared to smaller, growth-oriented ones.

🔹 Diversification: Diversifying investments across various stocks and sectors helps manage risk. Spreading investments reduces the impact of losses from a single investment and allows for capitalizing on growth opportunities across different sectors. Incorporating diversification into investment strategies aligns portfolios with risk tolerance and financial goals.

What Determines Stock Value

A stock’s value hinges on the interplay between supply and demand. Increased demand typically results in higher prices, while diminished demand tends to drive prices down. Additionally, a stock’s value is inherently tied to the potential returns it can offer to traders and investors. While some prioritize companies with strong fundamentals, others seek out smaller, undervalued companies poised for rapid growth. Various valuation methods exist to gauge whether stocks are undervalued or overvalued.

Identifying Undervalued and Overvalued Stocks

To pinpoint undervalued or overvalued stocks, a combination of fundamental and technical analysis is key. Fundamental analysis relies on eight popular ratios to assess a stock’s true value. However, integrating both fundamental and technical analyses offers a more comprehensive view of the market. The aim isn’t merely to find cheap or expensive stocks but rather to identify quality stocks priced below or above their fair values. The expectation is that market prices will eventually adjust to reflect true value, potentially leading to profitable opportunities by either going long on undervalued stocks or shorting overvalued ones.

Factors Influencing Stock Valuation

Buying stocks may deviate from their intrinsic values due to various factors such as market dynamics, news events, cyclical fluctuations, or misinterpreted financial results. Understanding these influences is crucial for assessing whether a stock is undervalued or overvalued in the current market environment. By staying attuned to market conditions and conducting thorough analyses, investors can better navigate opportunities for potential profit.

Is Stock Picking a Successful Strategy?

Stock picking, also known as active investment management, often falls short compared to a passive strategy that tracks broader stock market indexes. Studies reveal that over a 15-year span, more than 90% of stock pickers fail to outperform.

Challenges of Stock Picking:

The difficulty in stock picking arises from market efficiency, particularly over extended periods. According to the efficient market hypothesis (EMH), market prices incorporate all available information, making it challenging to achieve excess returns through stock selection.

Wrapping Up

In conclusion, navigating the stock market and identifying good stocks requires a blend of careful analysis, understanding of market dynamics, and clarity of investment objectives. By following a systematic approach outlined in this guide, investors can enhance their ability to make informed decisions and potentially capitalize on profitable opportunities.

It’s crucial to remember that investing in stocks carries inherent risks, and no strategy can guarantee success. While thorough research, fundamental and technical analysis, and risk assessment are vital components of stock selection, investors must also remain vigilant and adaptable in response to market fluctuations and evolving economic conditions.

Moreover, while stock picking can be an appealing strategy for some investors, it’s essential to acknowledge the challenges associated with it, including market efficiency and the difficulty of consistently outperforming the broader market over the long term. Therefore, investors should carefully weigh the pros and cons of active versus passive investment approaches and consider diversifying their portfolios to manage risk effectively.

Investing in stocks demands diligence and a strategic approach. Navia, as your trusted partner, empowers you with expert tools and insights. While acknowledging the challenges in stock picking, the collaboration with Navia ensures a comprehensive strategy, positioning you for long-term financial success in the dynamic world of stock market