Investing through IPOs: Pros & Cons

In the ever-evolving landscape of investment, Initial Public Offerings (IPOs) represent a pivotal moment not only for companies going public but also for investors looking to diversify their portfolios. As the Chief Marketing Officer of Navia Markets, a company at the forefront of offering comprehensive stock broking services, I’ve witnessed firsthand the surge in interest surrounding IPOs. But like any investment, diving into IPOs comes with its own set of advantages and challenges. Let’s unpack them.

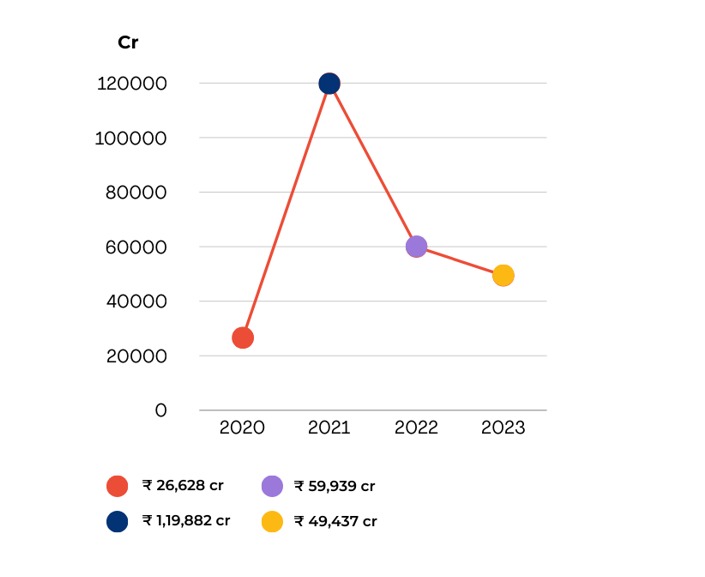

Tracking IPO Growth: Annual Amounts Raised from the year 2020 to 2023.

Pros of Investing in IPOs:

🔸 Opportunity for Early Investment

IPOs offer investors a chance to get in on the ground floor. For companies with strong fundamentals and growth prospects, this early investment can translate into substantial returns as the company matures and expands its market share.

🔸 Potential for Quick Gains

Some IPOs experience a significant price jump on the first day of trading, offering investors an opportunity for quick gains. This “IPO pop” can be particularly attractive for short-term traders looking to capitalize on market sentiment.

🔸 Diversification

Adding IPOs to your investment portfolio can introduce a new layer of diversification. Investing in a newly public company can provide exposure to emerging sectors and technologies, potentially hedging against downturns in other areas of your portfolio.

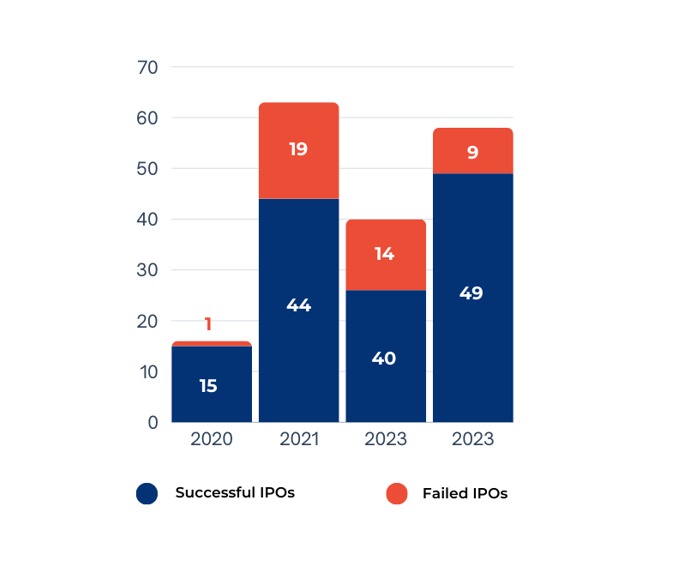

A Comparison of Successful and Flopped IPOs

Cons of Investing in IPOs:

🔸 Volatility and Uncertainty

IPOs can be highly volatile in the short term. The lack of historical market data can make it challenging to accurately value the company, leading to price fluctuations that may not align with the company’s fundamentals.

🔸 Risk of Overvaluation

Companies going public often attract a lot of attention and hype, which can lead to overvaluation. Investors jumping in on the buzz may find themselves holding shares priced well above their actual value, which can lead to losses as the market corrects.

🔸 Lock-Up Periods

It’s common for IPOs to have lock-up periods, where early investors and insiders are prohibited from selling their shares for a certain timeframe. This can limit liquidity and potentially lead to a drop in share price once the lock-up period expires and selling begins.

Navigating the IPO Landscape with Navia Markets!

At Navia Markets, we understand the allure and the apprehensions surrounding IPO investments. Our approach is rooted in thorough research, strategic planning, and a deep understanding of market dynamics. We empower our clients with the knowledge and tools they need to make informed decisions, whether they’re looking to explore the opportunities IPOs offer or diversify their investment portfolio further.

Investing through IPOs can be a lucrative venture, but it’s essential to approach it with a balanced perspective, acknowledging both its potential rewards and inherent risks. As you consider adding IPOs to your investment strategy, remember the importance of due diligence, strategic timing, and a well-rounded portfolio to navigate the complexities of the market successfully.