Navia Weekly Roundup (Mar 18- Mar 22, 2024)

Week in the Review

Indian market ended with moderate gains the week ended March 22 amid high volatility after no change in interest rates by the Fed and sticking to the previous forecast of three rate cuts in 2024, a fall in crude oil prices, subdued guidance from a global IT player Accenture and consistent FII selling.

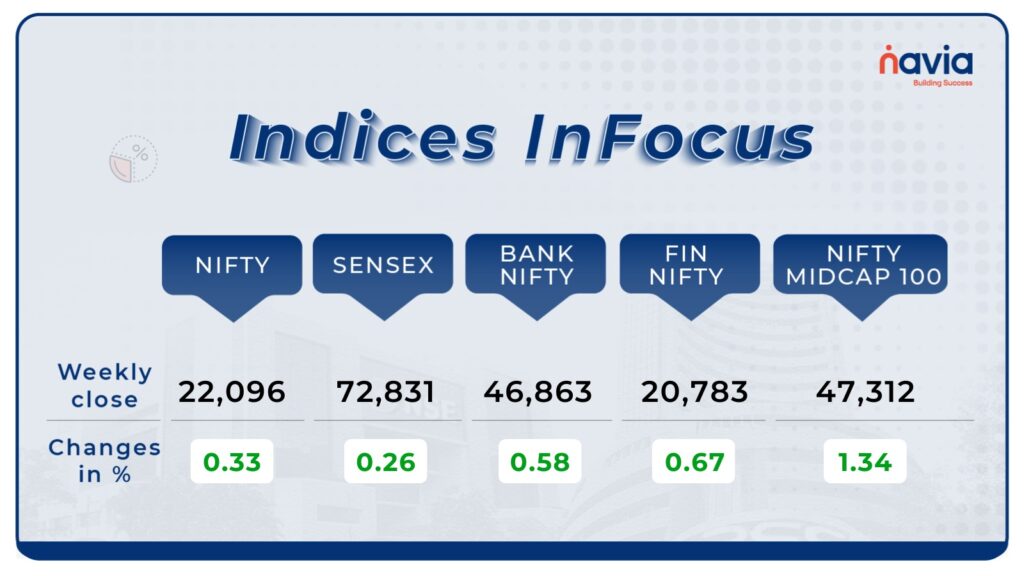

Indices Analysis

BSE Sensex:

The BSE Sensex witnessed a modest uptick this week, adding 0.26 percent to close at 72,831. Despite lingering uncertainties in the global market, the Sensex managed to hold its ground, reflecting resilience in the Indian market amidst fluctuating conditions. The incremental growth hints at underlying confidence among investors, albeit with a cautious approach.

Nifty50 Index:

Similarly, the Nifty50 index showed resilience and closed the week on a positive note, rising by 0.33 percent to end at 22,096. This upward movement signifies a continuation of the bullish sentiment observed in the market, driven by various factors including positive earnings outlooks, government policies, and global market cues.

For any further queries, you can now contact us on WhatsApp!

Interactive Zone!

Q) Which of these authorities supervise India’s capital markets?

Last week’s poll:

Q) Who is typically the biggest player moving the Indian stock market on a day to day basis?

a) Foreign Institutional Investors

b) Domestic Institutional Investor

c) Retail Traders

d) brokers

Last week’s poll answer: c) Retail Traders

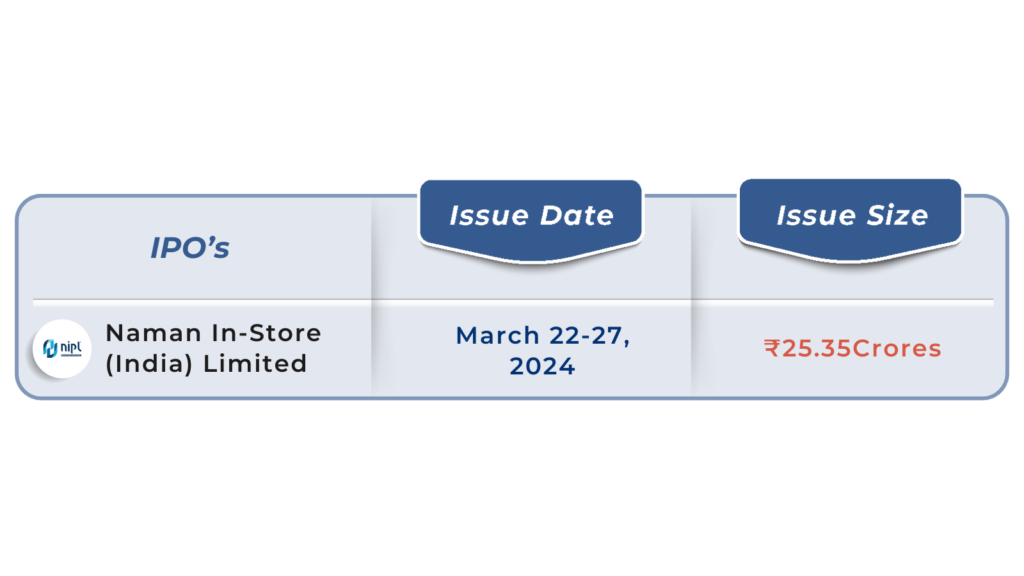

IPO Corner: Ongoing IPO’s

Naman In-Store IPO – Massive Response on Day One!

Naman In-Store’s IPO witnessed overwhelming demand from retail, non-institutional, and qualified institutional buyers (QIBs) on its first day. According to analysts the IPO was oversubscribed by an astounding 16.32 times! Retail investors showed exceptional interest with a subscription rate of 23.80 times, followed by non-institutional buyers at 14.25 times, and QIBs at 4.79 times. The company received bids for 3,09,24,800 shares against 18,94,400 shares on offer.

This fresh equity issue of 28.48 lakh shares, priced in the range of Rs 84-89 per share, closes on March 27. Investors can bid for 1,600 shares in one lot. The net proceeds will be utilized for capital expenditure to acquire leasehold land, construct factories, and for general corporate purposes.

With revenues of Rs 79.21 crore and a net profit of Rs 6.18 crore for the period ended September 2023, Naman In-Store demonstrates strong potential for growth and expansion.

Stay tuned for further updates as this promising IPO journey unfolds! 📈📊

Now with N Coins, Navia customers can #Trade4Free.

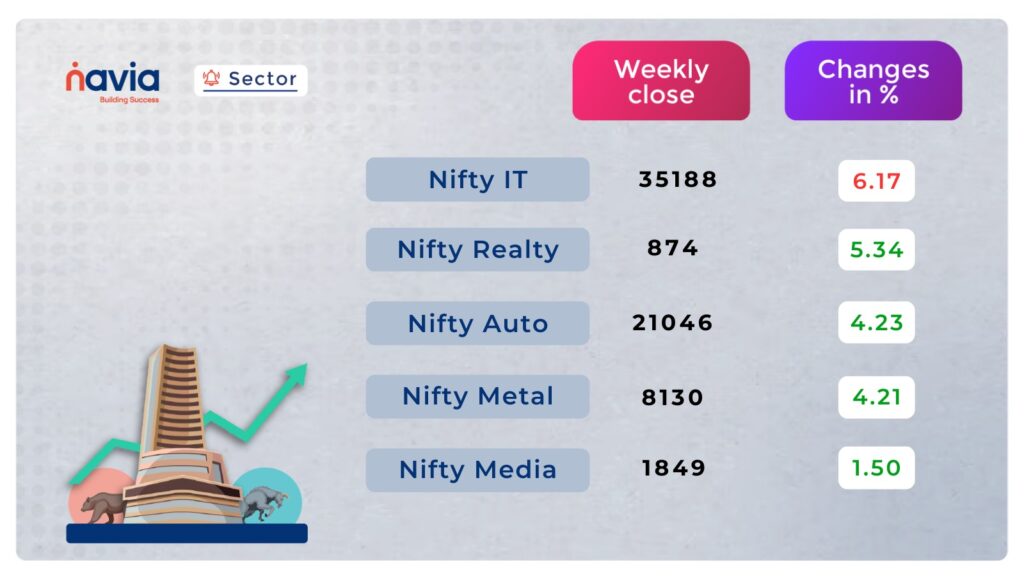

Sector Spotlight

This week’s Sector Spotlight unveils a mixed bag of sectoral movements. The Nifty Information Technology index dipped by 6.17 percent following Accenture’s revenue projection revision. However, we saw positive gains elsewhere with the Nifty Realty index rising by 5.34 percent, Nifty Auto increasing by 4.23 percent, and Metal indices adding 4.21 percent.

Explore Our Features!

Master your investment journey with Navia App’s Stock SIP feature! Learn how to create a basket, add favorite stocks, and set up SIP orders with our tutorial. To know more, watch the video below.

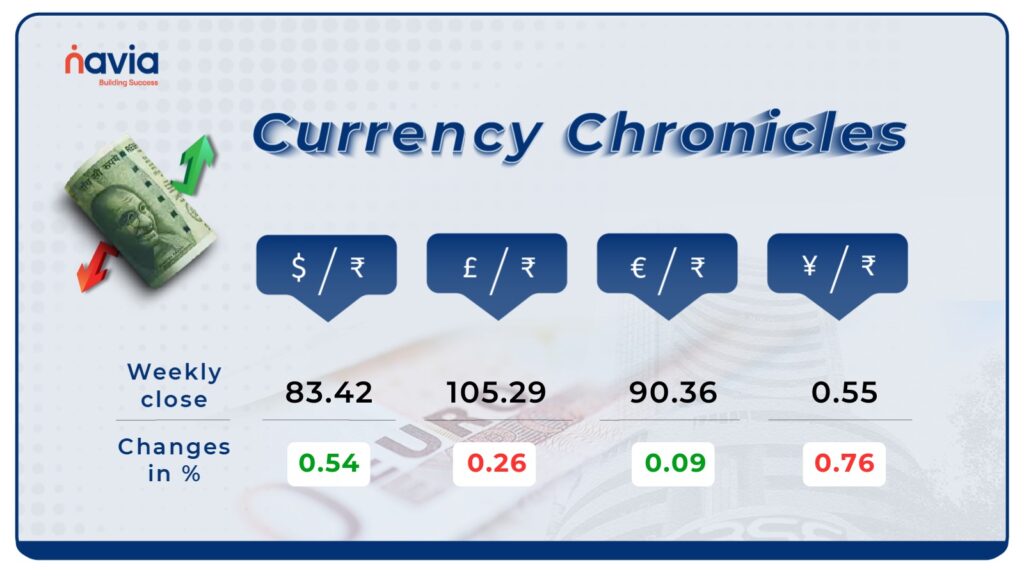

Currency Chronicles

USD/INR

The Indian rupee continued to face downward pressure against the US dollar, depreciating by 54 paise in the week ended March 22, closing at 83.42 compared to the March 15 closing of 82.88.

EUR/INR

Over the course of the week, the EUR to INR exchange rate demonstrated a slight increase of 0.09%. Bullish sentiment prevailed in the EUR/INR market, indicating optimism among traders and investors. By the end of the week, the EUR to INR rate reached ₹ 90.36, showcasing the strengthening of the Euro against the Indian Rupee.

JPY/INR

Despite a decrease of -0.76% in the week, bullish sentiment persists in the JPY/INR market. Traders and investors remain optimistic despite the decline in the exchange rate. Current estimates suggest that the JPY to INR rate will reach ₹ 0.554607 by the end of the week.

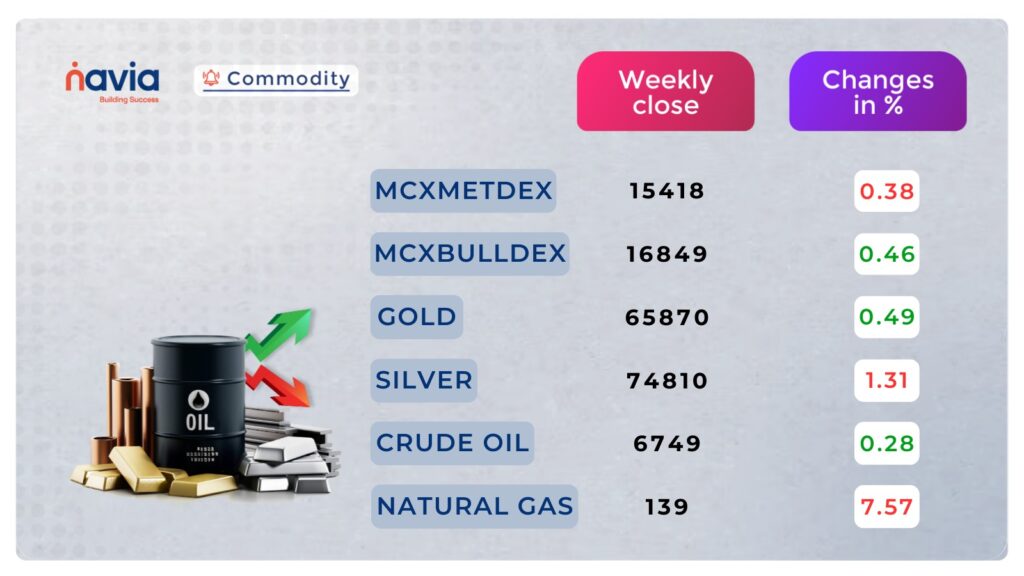

Commodity Corner

Gold

Gold prices saw an upward surge on Friday, buoyed by the U.S. Federal Reserve’s decision to maintain interest rate cut forecasts. This marked a potential fourth weekly gain in the last five weeks. Resistance for gold is at 66878, with support at 65196.

Crude oil

Oil prices experienced a decline on Friday amidst prospects of a Gaza ceasefire easing tensions in the Middle East. Pressure was also exerted by a robust dollar and weakening U.S. gasoline demand. Resistance stands at 6875, while support rests at 6650.

Blog of the Week

Discover the stability and growth potential of Indian PSUs – perfect for diversifying your portfolio. To delve deeper, Read more on our latest blog about Indian PSUs.

N Coins Rewards

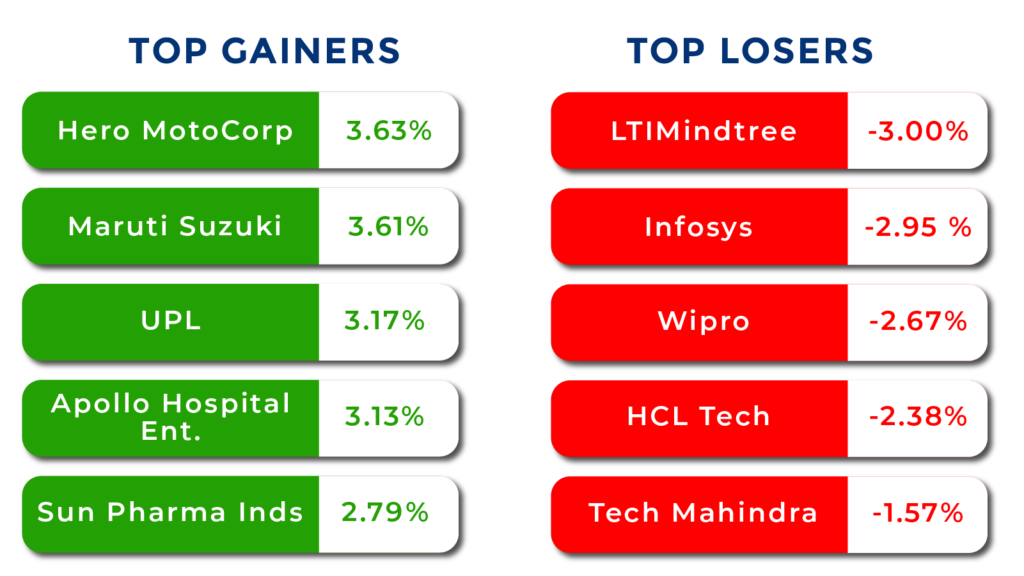

Top Gainers and Losers

Join Navia and trade like a pro!

“Empowerment, innovation, resilience: Women leaders shaping Navia Markets and beyond“

Refer your Friends & Family and GET 500 N Coins.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Do You Find This Interesting?