Weekly Wrap-Up (FEB 12 – FEB 16, 2024)

The Nifty concluded the week above 22,000, experiencing a 1% surge fueled by the robust performance of the auto, oil & gas, and banking sectors. Despite the index ending flat, small-caps delivered double-digit returns. The market rebounded from earlier losses, buoyed by positive global indicators, encouraging domestic inflation data, and the final quarter earnings reports from Indian companies

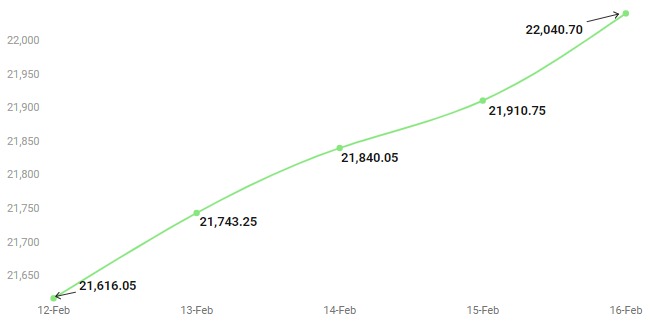

Indices Weekly Performance

This week, Nifty gained 1.19 percent to reach 22,040. while BSE Sensex increased by 1.16 percent, closing at 72,426.

For any further queries, you can now contact us on WhatsApp!

Indices Analysis

NIFTY 50

The Sensex and the Nifty were hovering close to their record highs on February 16 afternoon, powered by gains in auto and healthcare names. At 12.34 pm, the Sensex was up 345.42 points or 0.48 percent at 72,545.33 and the Nifty was trading 124.70 points or 0.57 percent higher at 22,068.65

The Nifty is now approaching the upper boundary placed in the zone of 22100 – 22150 where it has faced resistance on two occasions which increases its importance. The steep rise in the last three trading sessions is losing momentum and is evident on the hourly momentum indicator which is on the verge of a negative crossover. Overall, we are expecting the range-bound action to continue. The inability to decisively cross the recent swing high of 22150 can lead to a fall in the Nifty and hence caution is advised.

BANK NIFTY

Bank Nifty tried to climb above the downward-sloping resistance trendline but could not, though the uptrend continued for the fourth day. The index closed 166 points higher at 46,384. It formed a small bearish candlestick with a long upper shadow on the daily timeframe, indicating selling pressure at higher levels. The index rallied 1.64 percent during the week and formed a bullish candlestick with a long lower shadow on the weekly scale.

Nifty Chart

The momentum indicator RSI has experienced a bullish crossover following a base formation. In the short term, the index might move towards 22,200; a move above 22,200 could potentially take the Nifty towards 22,600. Support on the lower end is placed at 22,750.

Now with N Coins, Navia customers can actually #Trade4Free.

INDIA VIX

The India VIX, a gauge of the market’s expectation of volatility over the near term, slipped 5.61%

Refer your Friends and family and GET 500 N Coins.

Use N Coins to Redeem all Charges. #Trade4Free.

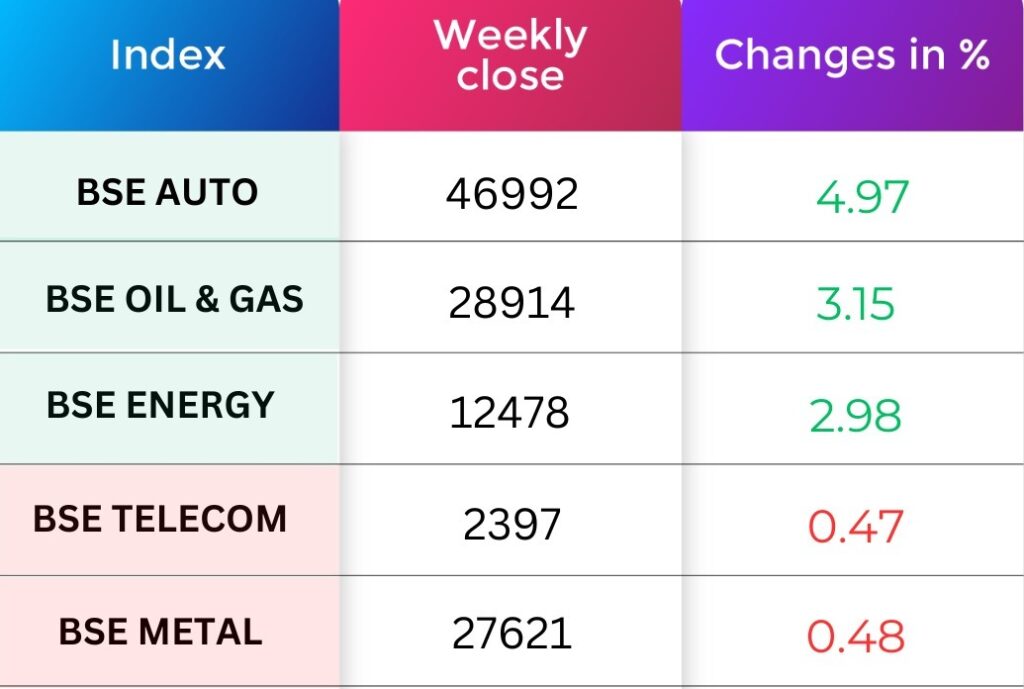

Sectoral Performance

On the sectoral front, BSE Auto index rose 4.97 percent, BSE Oil & Gas index gained 3.15 percent, BSE Energy index rose 2.98 percent. On the other hand, BSE Telecom slipped 0.47 percent, and Metal indices were down 0.48 percent.

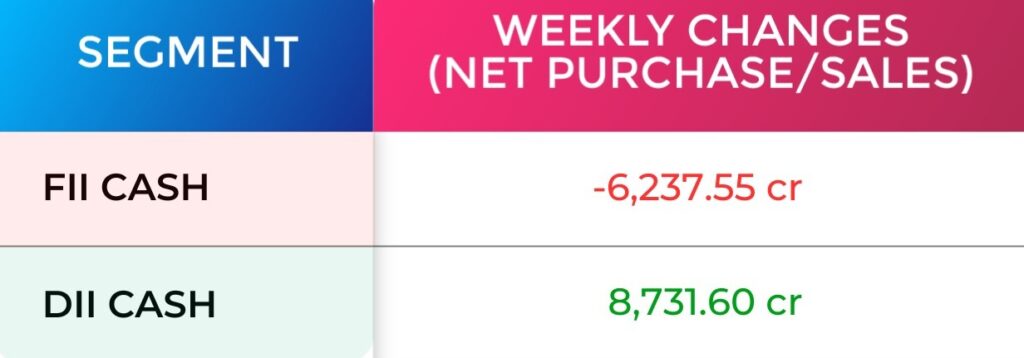

FII & DII Weekly Activity

Foreign institutional investors (FIIs) extended the selling in this week and they sold equities worth of Rs 6,237.55 crore, while Domestic institutional investors (DIIs) have provided support with buying equities worth Rs 8,731.60 crore during the week. However, in the month of February till now, the FIIs sold equities worth Rs 13,917.89 crore, while DIIs bought equities worth Rs 17,393.01 crore.

Global Market

The S&P 500 closed above 5,000 for the fourth time this year thanks to robust corporate earnings and surging enthusiasm around artificial intelligence.

The S&P 500 dropped 0.42% to close at 5,005.57, the Nasdaq Composite decreased by 1.34% to 15,775.65, and the Dow Jones Industrial Average fell by 0.07% to 38,627.99.

Currency Indices

The Indian rupee ended flat at 83.01 for the week ended February 16 against the February 9 closing of 83.03.

Poll of the week

Last week’s poll:

Q) Indian Stock market movements are influenced by:

a) Global Factors

b) Domestic Factors

c) All of the above

Last week’s poll answer: c) All of the above

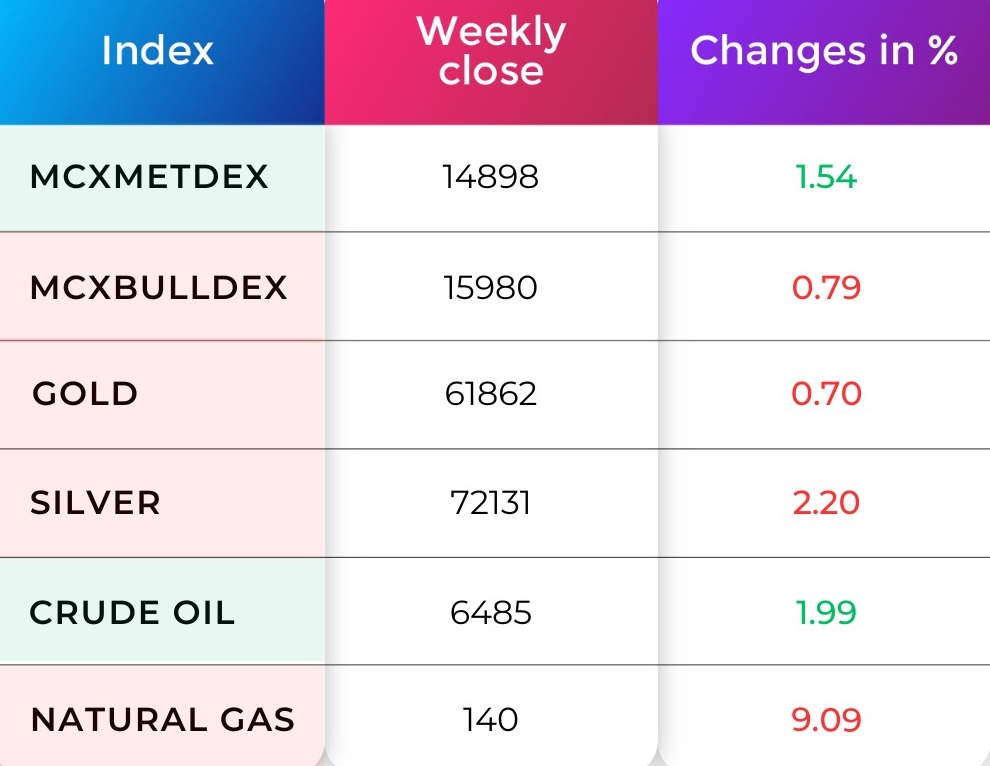

Commodity Market

Crude oil is showing an uptrend movement, underpinned by geopolitical uncertainties in the Middle East and OPEC+ efforts to curb oil supply. The current R1 is placed at 6374, and S1 is placed at 6556 levels.

Currently, gold is at price levels of the second week of December. The overnight fall in U.S. bond yields and a weaker dollar negatively affect upcoming trade. The current R1 is placed at 61,687, and S1 is placed at 60,996.

Blog Of The Week!

Did you Know?

The Man Behind BSE’s Success

In the early days, stock trading was done under the banyan trees. But since 1875, BSE continues to have its head office located at Dalal Street. Currently, BSE is the world’s 10th largest stock exchange by market capitalization and has over 5000 companies listed on it.

Very few people know about the man behind its gigantic success. BSE was founded by Premchand Roychand on July 09, 1875. It became Asia’s first-ever fully functional stock exchange. Mr Premchand was a prominent figure in Mumbai’s business and trading circuit. He was also called Cotton King, and the Big Bull.

Refer your Friends & Family and GET 500 N Coins.

Use N Coins to Redeem all Charges. #Trade4Free.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Do You Find This Interesting?

Happy Learning,

Team Navia