Navia Weekly Roundup (Mar 04- Mar 07, 2024)

Week in the Review

During the fourth consecutive week ending on March 7, the Indian market sustained its rally, reaching fresh record highs for benchmark indices. The Nifty 50, in particular, concluded at a record closing high amidst rangebound trade, benefitting from the consistently declining India VIX, which favored the bulls. Throughout this period, the index demonstrated a higher highs, higher lows formation and consistently remained above all key moving averages on both daily and weekly charts. These indicators suggest that market sentiments continue to support the bulls.

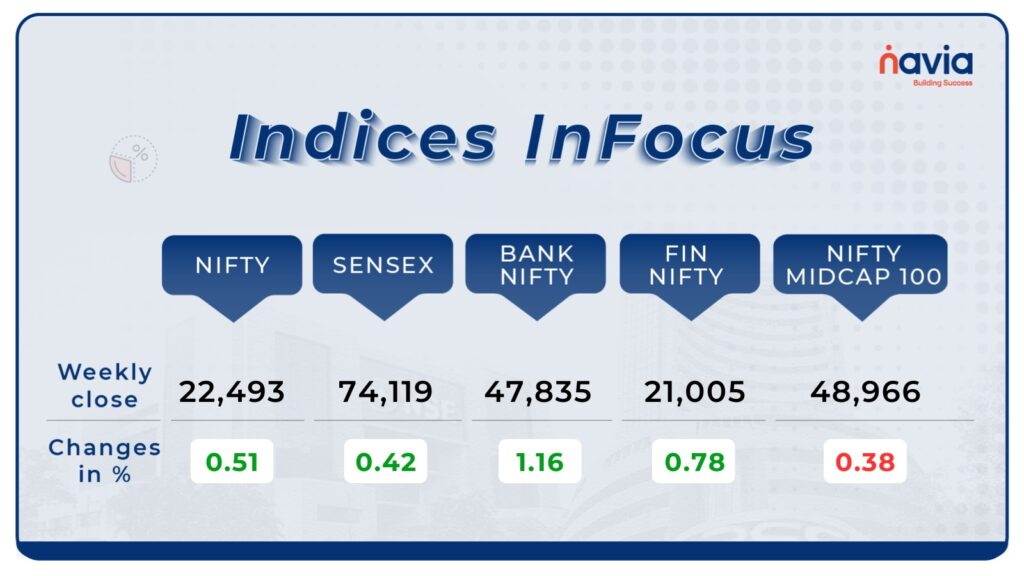

Indices Analysis

The Sensex was up 0.42 percent at 74,119.39, and the Nifty was up 0.51 percent at 22,493.50. About 2,034 shares advanced, 1,626 shares declined, and 110 shares remained unchanged.

For any further queries, you can now contact us on WhatsApp!

IPO Corner

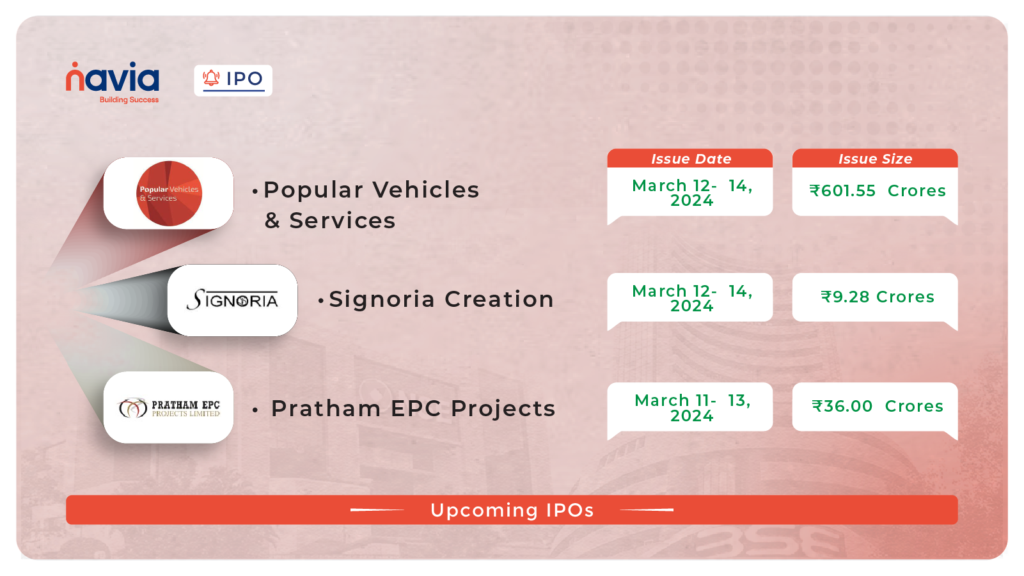

Popular Vehicles & Services IPO: Revving Up for Investment Opportunities!

Don’t miss out on the Popular Vehicles & Services IPO, open for subscription from March 12 to March 14, 2024. Expected to list on both BSE and NSE on Tuesday, March 19, 2024, this IPO offers shares at ₹280 to ₹295 per share with a minimum lot size of 50 shares. Established in 1983, Popular Vehicles & Services is a leading player in the automobile dealership sector in India. The IPO proceeds will be used for loan repayments and general corporate purposes.

Signoria Creation IPO: Mark Your Calendars for an Exciting Opportunity!

Get ready for the Signoria Creation IPO, opening for subscription from March 12 to March 14, 2024. The allotment is expected to be finalized on Friday, March 15, 2024, with a tentative listing date on Tuesday, March 19, 2024, on NSE SME. With a price band of ₹61 to ₹65 per share and a minimum lot size of 2000 shares, this IPO offers a chance to invest in a promising venture. The funds raised will be utilized for working capital requirements and general corporate purposes.

Pratham EPC Projects IPO: A New Venture in Engineering and Construction!

Launching on March 11 and closing on March 13, 2024, the Pratham EPC Projects IPO is set to make waves. Expected to list on NSE SME on Monday, March 18, 2024, this IPO comes with a price band of ₹71 to ₹75 per share and a minimum lot size of 1600 shares. With its focus on oil and gas utilities and a comprehensive suite of services, Pratham EPC Projects presents an exciting investment opportunity. The proceeds will go towards machinery purchase, working capital requirements, and general corporate purposes.

Stay tuned as we continue to track the exciting developments in the world of IPOs. Don’t miss out on the latest updates and market trends – subscribe to our newsletter today! 📈📊

Now with N Coins, Navia customers can #Trade4Free.

Sector Spotlight

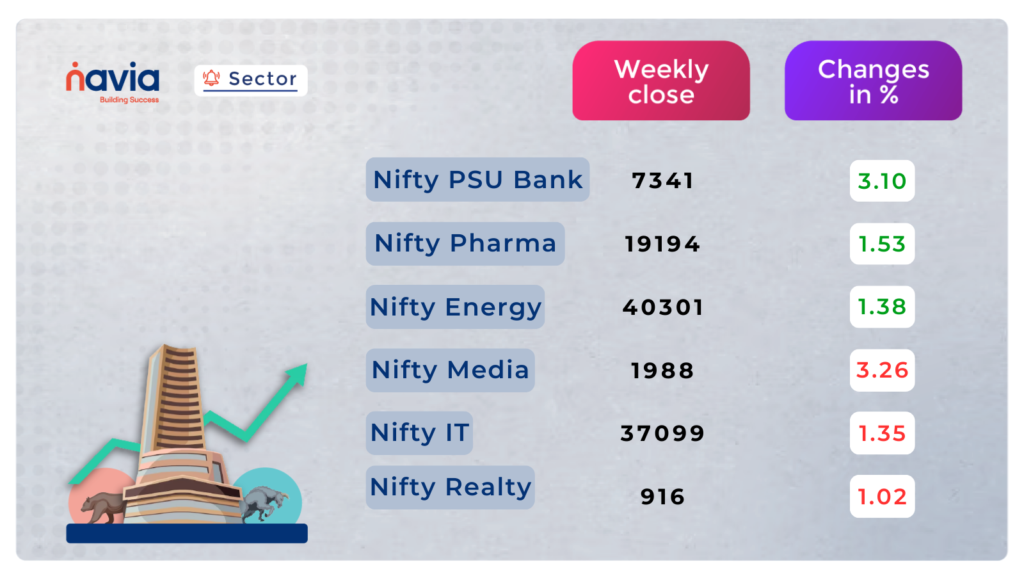

In the dynamic landscape of sectors, the Nifty PSU Bank index exhibited resilience, surging by an impressive 3.10 percent, while the Nifty Pharma index experienced a notable uptick of 1.53 percent. The energy sector also saw positive gains, with the Nifty Energy index rising by 1.38 percent. Conversely, facing a downturn, the Nifty Media sector encountered a setback, losing 3.26 percent, accompanied by a 1.35 percent decline in the Nifty Information Technology index and a marginal dip of 1.02 percent in the Nifty Realty index. This sectoral ebb and flow added an intricate layer to the overall market narrative.

Explore Our Features!

Price Alert

Effortlessly monitor your stocks with Navia App: Set price alerts and receive notifications when your target is reached, ideal for traders seeking hassle-free updates to trade smarter.

Currency Chronicles

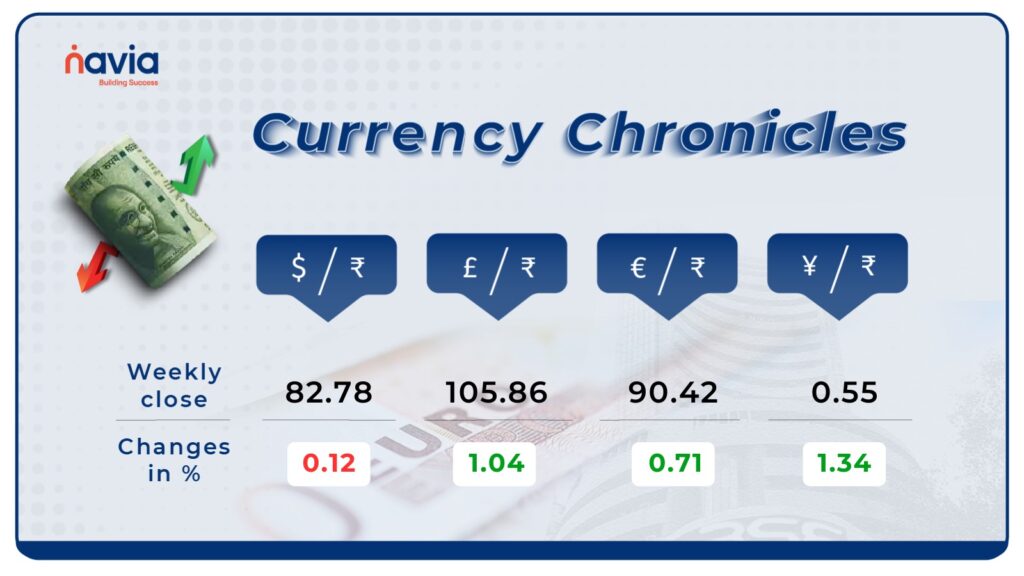

USD/INR:

The Indian rupee closed the week at 82.7850 against the U.S. dollar, marking a modest gain of 0.12% compared to the previous week. This marks the fourth consecutive weekly gain for the rupee. Despite reaching its strongest level in six months on Thursday, aided by dollar sales from large foreign banks, the local currency faced pressure from likely intervention by the Indian central bank, which eroded some of its early gains.

EUR/INR:

Over the week ending March 7th, 2024, the EUR to INR exchange rate rose by 0.71%, indicating bullish sentiment in the market. By week’s end, the rate closed higher as expected, highlighting the Euro’s strength against the Indian Rupee.

JPY/INR:

During the week until March 7th, 2024, the JPY to INR exchange rate climbed by 1.34%, signaling optimism in the market. By the week’s close, the rate had reached ₹ 0.558670, marking a notable uptick in the value of the Japanese yen compared to the Indian Rupee.

Commodity Corner

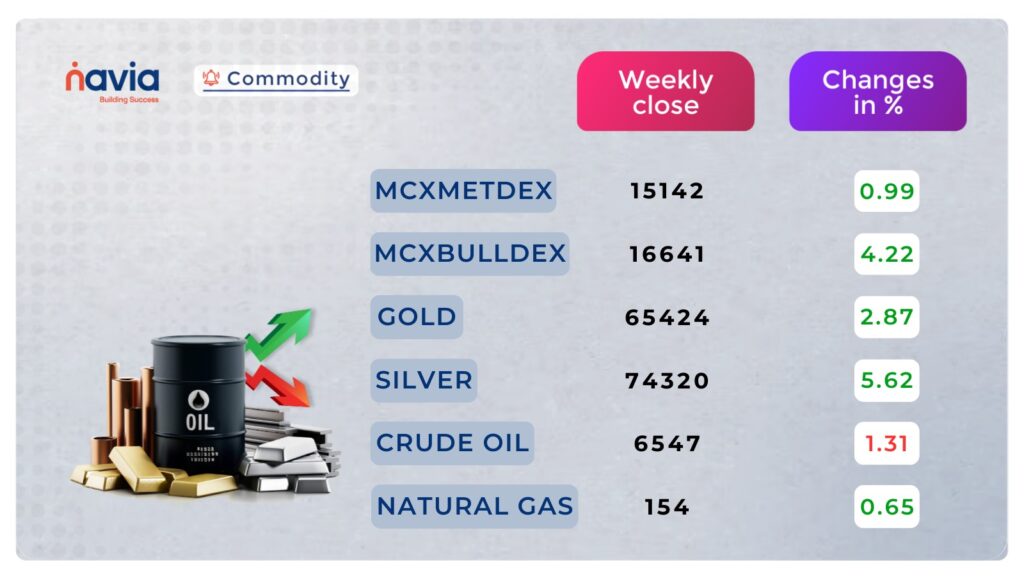

Gold:

The past five trading sessions witnessed gold trading with robust positive momentum, reaching new highs. Closing with a notable gain of 2.87%, gold prices surged. This uptrend is fueled by several factors including expectations for U.S. rate cuts, geopolitical tensions, and concerns surrounding China’s economic situation.

Crude Oil:

Crude oil prices pirouette to the beats of demand surges in the US and China, harmonized with positive signals for rate cuts. Last week witnessed a negative closure at -1.31%. Currently, the stage is set with R1 at 6588 and S1 at 6503, adding a dynamic flair to this market performance.

Blog of the Week

Crack the code of picking Good stocks – Read more insights from our latest blog to navigate your investment journey.

Interactive Zone!

Last week’s poll:

Q) Share of profit, if distributed by management in cash is called as?

a) Bonus

b) Rights

c) Dividend

Last week’s poll answer: c) Dividend

N Coins Rewards

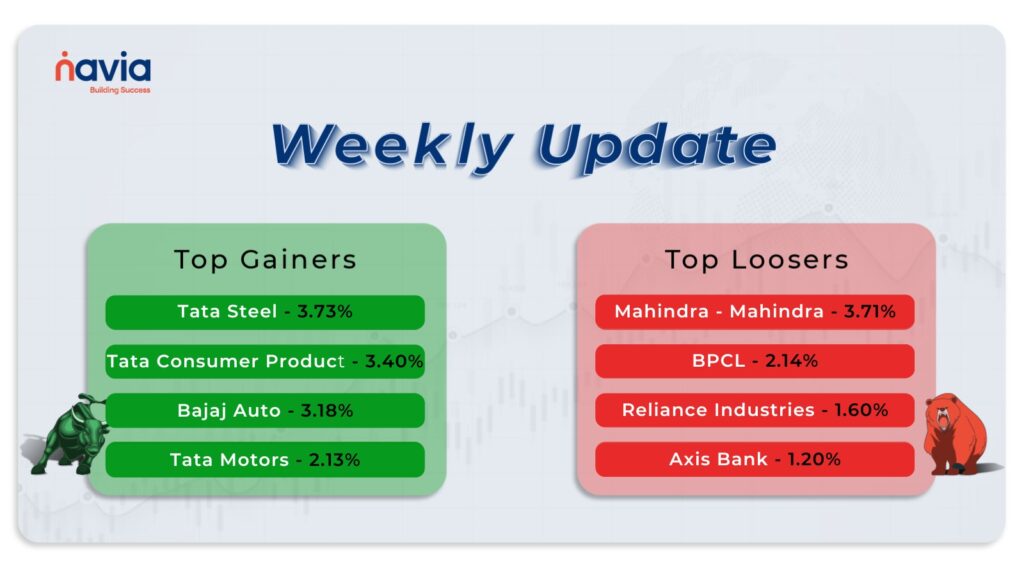

Top Gainers and Losers

Join Navia and trade like a pro!

Ready to elevate your financial journey? Discover the potential of MTF with Navia and watch your investments ascend to new heights.

Refer your Friends & Family and GET 500 N Coins.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Do You Find This Interesting?

Happy Learning,

Team Navia