Navia Weekly Roundup (Mar 11- Mar 15, 2024)

Week in the Review – Market Ends Four-Week Winning Streak Amid Small-cap Decline, IT Stocks Shine

The Indian stock market broke its four-week streak of gains, experiencing its largest weekly losses in the past five months by the end of a volatile week on March 15. This was driven by a combination of mixed domestic and global data and a cautious approach towards midcap and smallcap stocks.

Foreign institutional investors (FIIs) curtained their selling during the week as they sold equities worth of Rs 816.91 crore, while Domestic institutional investors (DIIs) continued their support as they bought equities worth Rs 14,147.5 crore.

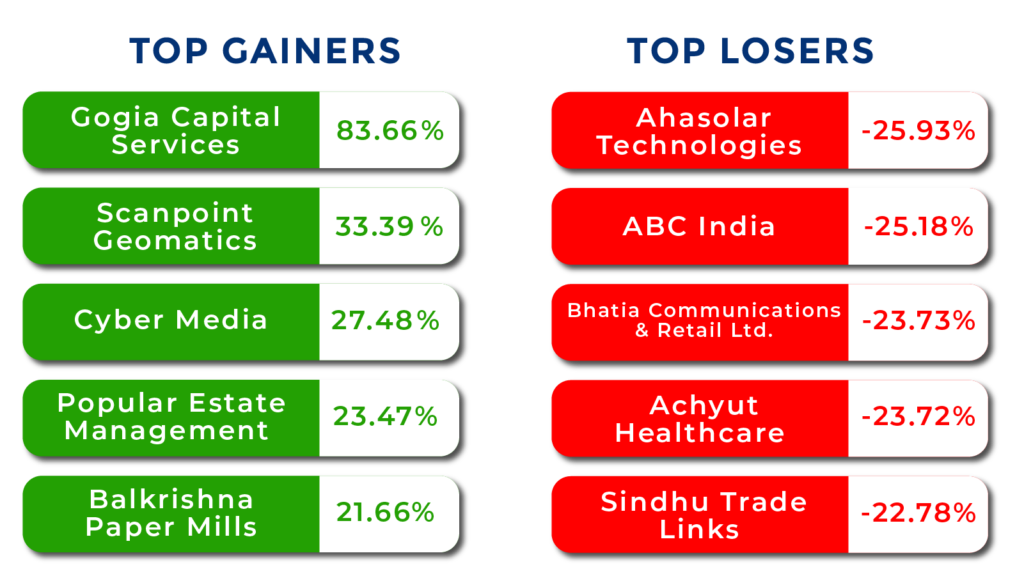

The BSE Small-cap index plummeted by 6%, witnessing notable declines in stocks such as India Pesticides, Paisalo Digital, and Gensol Engineering, among others, with losses ranging from 20% to 40%. Meanwhile, gainers included companies like Hercules Hoists, Astec Lifesciences, and Reliance Infrastructure.

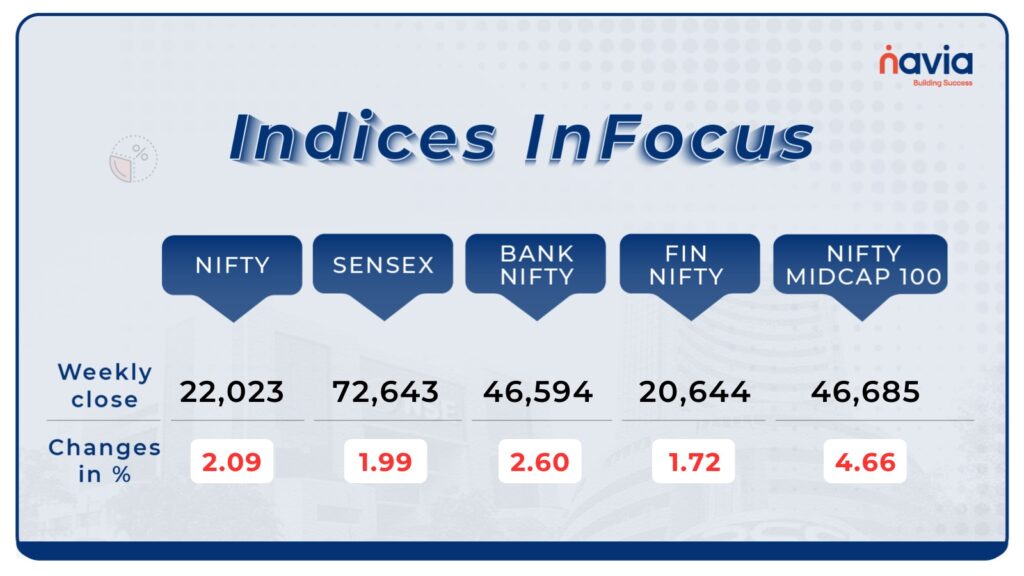

Indices Analysis

This week, both the BSE Sensex and the Nifty50 index experienced significant declines, with the Sensex dropping 1.99 percent to 72,643 and the Nifty50 falling 2.09 percent to 22,023. Understanding the reasons behind these shifts is crucial, considering factors like global economic indicators and geopolitical tensions. Analyzing these indices provides insights into market sentiment and future trends, guiding strategic investment decisions amid short-term volatility.

For any further queries, you can now contact us on WhatsApp!

Interactive Zone!

Q) Who is typically the biggest player moving the Indian stock market on a day to day basis?

Last week’s poll:

Q) Are the new IPOs coming into the market overpriced for their business quality?

a) No, these IPOs are valued competitively compared to peers

b) Yes, investors are subscribing only for listing gains

Last week’s poll answer: A) 75% B) 25%

IPO Corner: Ongoing IPO’s

Enfuse Solutions IPO: Rapid Subscriptions Reflect Investor Confidence!

Enfuse Solutions’ IPO witnessed an impressive subscription rate of 3.4 times on the first day of bidding. With a price range of Rs 91-96 per share and a lot size of 1,200 shares, this fresh equity issue of 23.3 lakh shares closes on March 19. The net proceeds will be allocated towards debt repayment, working capital, and general corporate purposes. Enfuse Solutions operates across diverse sectors including data management, analytics, e-commerce, digital services, machine learning, AI, and edtech solutions.

Krystal Integrated Services IPO: Moderate Interest with Neutral Ratings!

Krystal Integrated Services’ IPO, currently open for subscription, has achieved a 48% subscription rate so far. This IPO comprises a fresh equity sale of Rs 175 crore and an offer for sale (OFS) of Rs 125 crore. Analysts have given a neutral rating due to perceived operational risks and valuation concerns, with the current Grey Market Premium (GMP) standing at Rs 70. Retail investors have subscribed 49%, while QIBs and NIIs have subscribed 34% and 65% respectively. The IPO proceeds will be utilized for debt repayment, working capital, capital expenditure, and general corporate purposes.

Stay tuned for more updates on these IPOs as they progress towards their closing dates. For the latest insights into investment opportunities, keep following our updates! 📈📊

Now with N Coins, Navia customers can #Trade4Free.

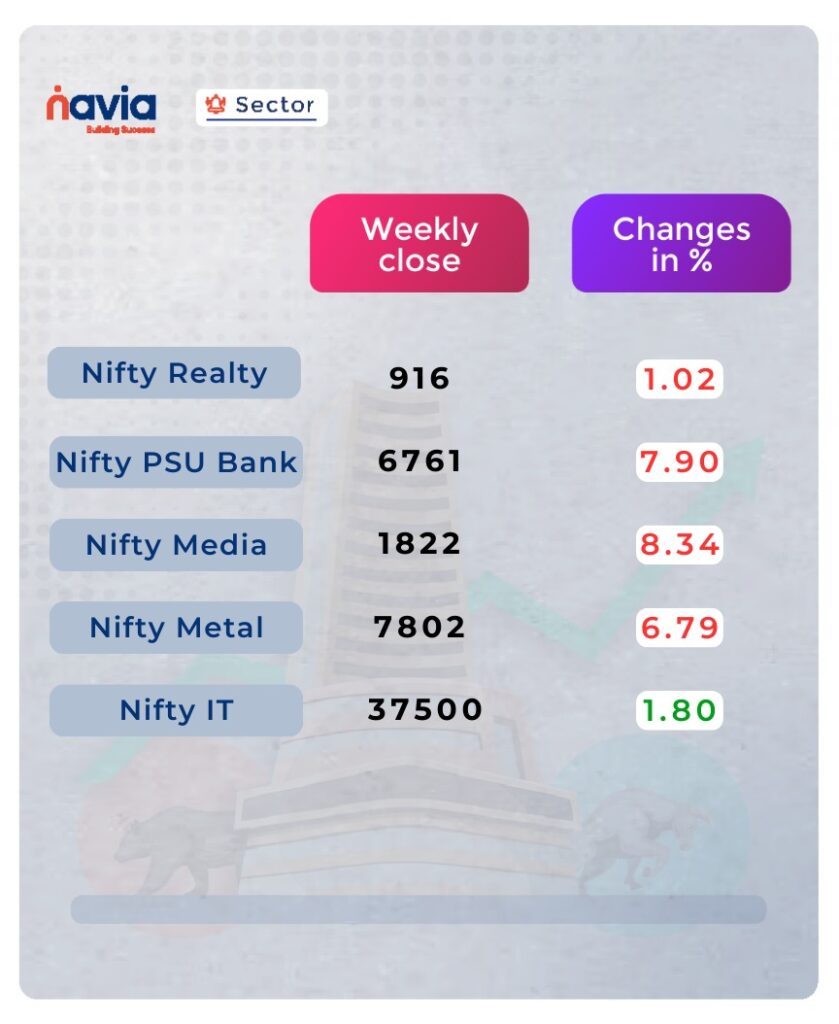

Sector Spotlight

This week, we observed significant movements across various indices. The Nifty Realty index dropped by 9.4%, reflecting challenges in the real estate sector amidst economic shifts. Similarly, the Nifty Media index declined by 8.3%, possibly influenced by changing consumer behavior and advertising trends.

Additionally, the Nifty PSU Bank slipped by 8%, indicating ongoing challenges within the public sector banking domain. Meanwhile, the Nifty Metal Index shed 6.8%, possibly responding to global economic dynamics and geopolitical factors.

In contrast, the Nifty Information Technology index rose by 1%, highlighting the resilience of the technology sector amidst uncertainty. Understanding these sectoral trends is crucial for informed decision-making in today’s dynamic market environment.

Explore Our Features!

Stock Analysis

Dive into the intricacies of the stock market through our tutorial on accessing market depth in the Navia App! Read more to unlock crucial insights about our stock analysis feature.

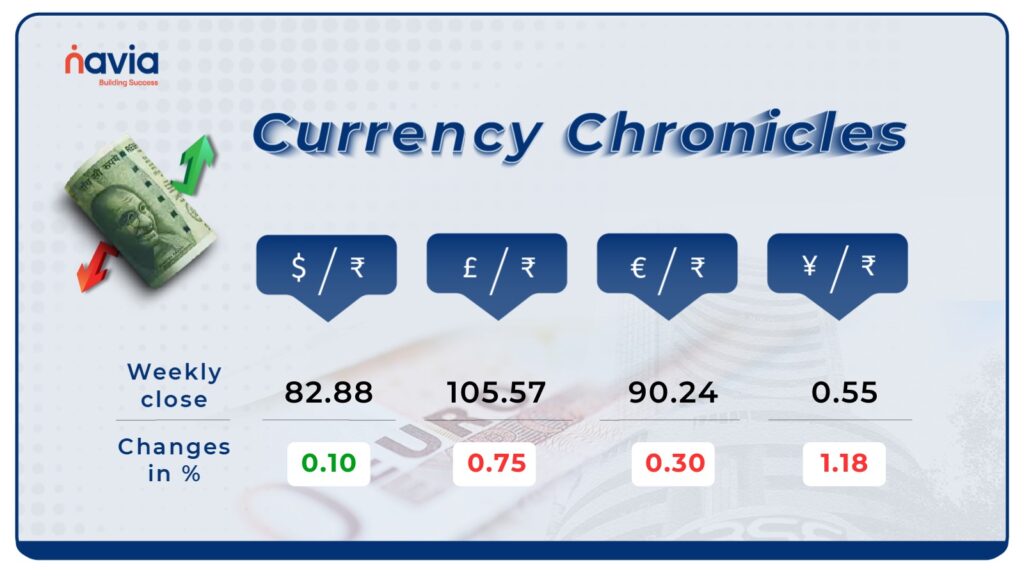

Currency Chronicles

USD/INR

In the week ending March 15th, the Indian rupee weakened by 10 paise against the US dollar, closing at 82.88 compared to the previous week’s closing of 82.78 on March 7th.

EUR/INR

The EUR to INR exchange rate witnessed a decline of -0.30% over the week, from its initial rate. Despite this, bullish sentiment prevailed in the EUR/INR market. By week’s end, the rate settled at ₹ 90.24, showing a modest increase.

JPY/INR

Similarly, the JPY to INR exchange rate experienced a decrease of -1.18% over the week, dropping from ₹ 0.556004 to ₹ 0.546937. Despite this decline, bullish sentiment persisted in the JPY/INR market. By week’s end, the rate settled at ₹ 0.55.

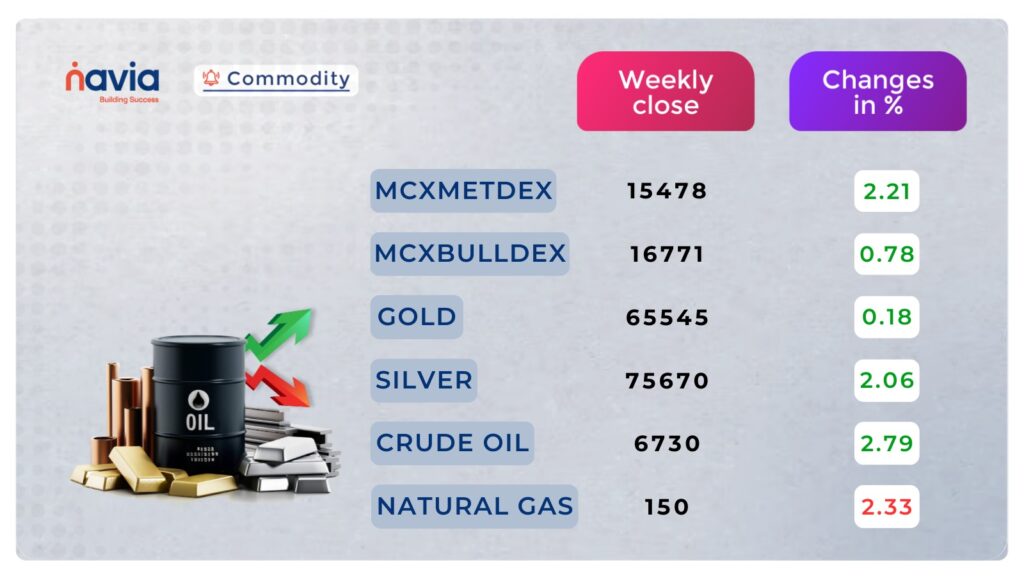

Commodity Corner

In the previous week, crude oil closed at 2.79% positive. The decline in US crude inventories signaled strong demand in crude oil price movement. The current R1 is placed at 6795 and S1 is placed at 6519.

After the strong uptrend movement, currently, gold experiences some consolidation, gold closed at 0.18% positive. Due to the weaker dollar and escalating geopolitical tensions, investors currently rely on gold. The current R1 is placed at 65967 , and S1 is placed at 65335.

Blog of the Week

Dive into the IPO Game: Navigating Pros and Cons. Read more to uncover the secrets behind investing in IPO’s.

N Coins Rewards

Top Gainers and Losers

Refer your Friends & Family and GET 500 N Coins.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Do You Find This Interesting?

Happy Learning,

Team Navia